Hedging the risk in the all-pervasive 60/40 portfolio — using the Allasso assets module for answers

Options threads and the Allasso assets module — taking direct aim at the 60/40 portfolio

Given fractures in the US Treasury market and a frothy S&P 500, how can we best hedge the risk in the all pervasive 60/40 stock/bond portfolio?

Suppose you're worried about downside in both the 60 (equities) and 40 (bonds) piece, have a static holding in each, and want to hedge. Recent bond auctions in the US, UK and Japan have been weak, suggesting that long term yields may have more space to the upside.

You choose put spreads for simplicity; they have bounded downside and are volatility insensitive relative to outright puts. Are you better off buying put spreads on the S&P or 10-year Treasury note?

In search of a more asymmetric payout

Here’s a decent way to frame the problem, and one that overcomes the multi-decade Treasury bull market issue.

How much of a sell off will I capture if I'm right, and what percentage of the pain will I take if I'm wrong?

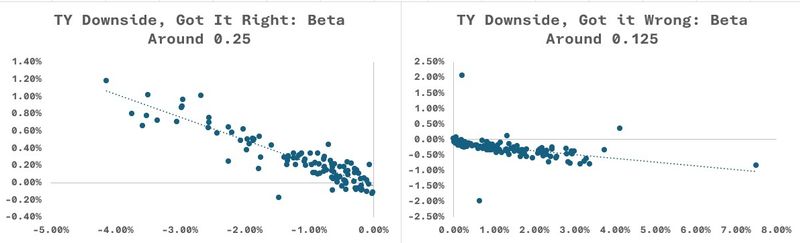

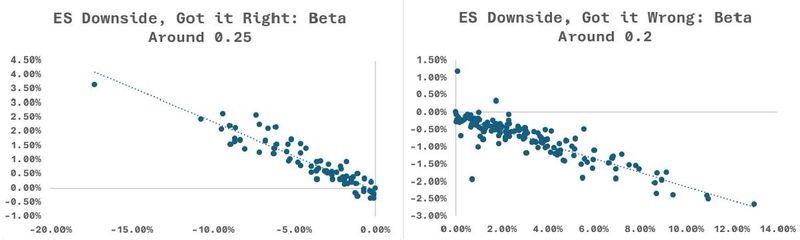

More concretely, I'm forced to buy a 40 delta/20 delta put spread on S&P Emini and 10-year Treasury Note futures, rolling with 30 days to maturity.

Assuming that I need to maintain a constant sized hedge over time, which market offers a more asymmetric payout?

The results were produced using the Allasso assets module, with returns uploaded to Excel and graphics produced in Excel.

Using monthly data from 2006 to March 2025, we can see that the beta "reward" for getting the direction right was around 0.25, while the penalty was around 0.125. Nice asymmetry there (𝗙𝗶𝗴𝘀 𝟭 𝗮𝗻𝗱 𝟮).

For clarity, "downside" refers to a decline in TY and equities, and "upside" refers to a rally in both.

By contrast, the reward/penalty betas for our S&P Emini put spreads are far more symmetric (𝗙𝗶𝗴𝘀 𝟯 𝗮𝗻𝗱 𝟰). If you fear that both legs of the 60/40 may go down together and want to hedge in the simplest possible way, moderately out of the money Treasury put spreads may be the answer.

As ever, this should not be construed as investment advice.